Infrastructure Strategy 2023: Building the Green Hydrogen Economy

As countries around the world rebuild their infrastructure for sustainability, private investors are gravitating toward low-carbon hydrogen projects.

Principal Investors and Private Equity

ByJohannes Glugla,Mark Harris,Ben Sheridan, andJan Kokavec

When rapid expansions slow, companies can often benefit from revisiting the cost structures they built up to support the growth. Alternative asset managers are no exception.

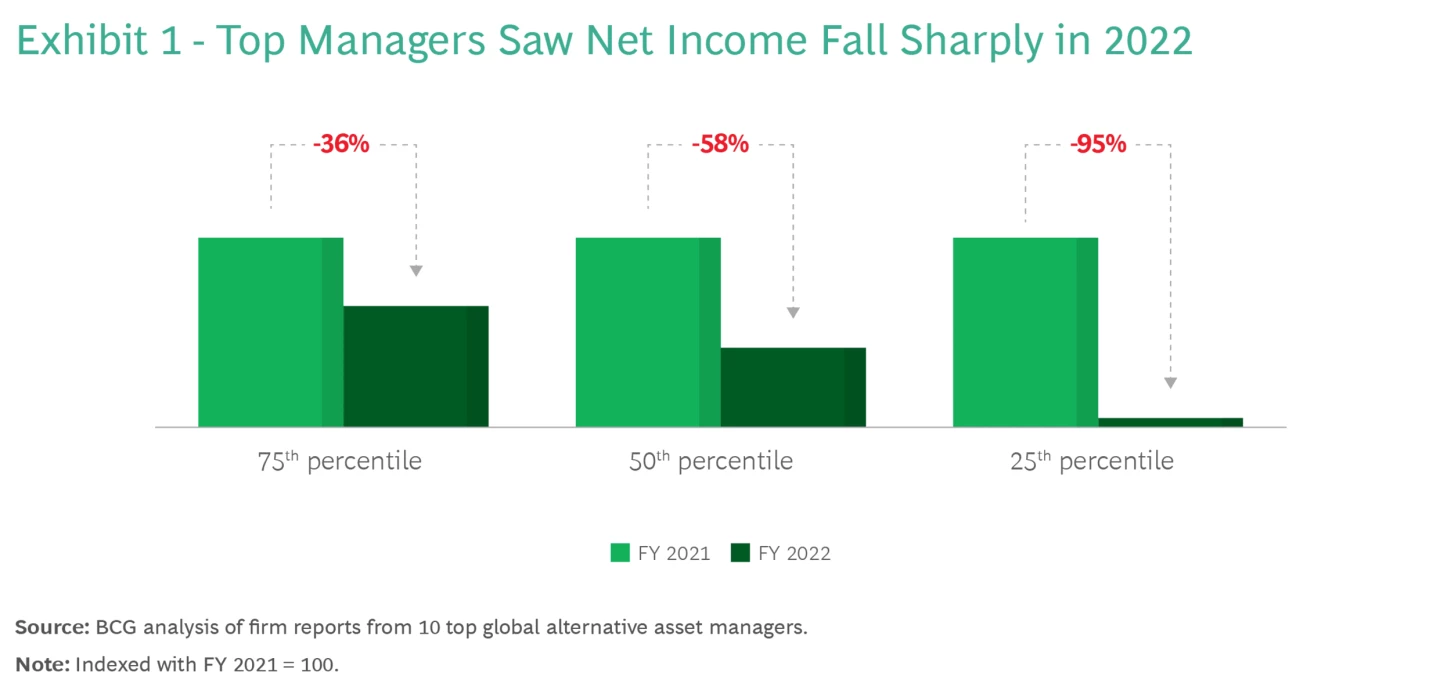

After a decade of record growth and profitability for most managers, rising interest rates and macroeconomic uncertainty took a major toll on 2022 earnings. (See Exhibit 1.) In 2023, expense management was one of the key themes in first-quarter earnings calls.

Although attention to costs isn’t new for some firms, during the long boom the industry as a whole was more focused on enabling growth. Today, while managers may be starting from different points, most have clear opportunities to improve efficiency. Some steps—such as centralizing, relocating, and perhaps outsourcing company-wide functions—are familiar but still underused in alternativeasset management.其他步骤需要作为一个先行者,尤其是lly inartificial intelligence(AI), with its potential for major productivity improvements across a firm.

As with all transformative initiatives, moving ahead requires committed leadership and careful planning using a proven change management playbook. But the work is worth doing: along with wider profit margins, the result will be an infrastructure that is better prepared to support further growth when the cycle turns.

The first step is building a detailed view of the cost structure that supports the firm’s activities in both the front and the back office. Costs need to be viewed on both an absolute basis and, crucially, relative to the firm’s peers. Comparing theorganization竞争对手的类似资料会给客y insights about how the organic expansion of recent years has shaped its cost structure and how it could be improved. The industry context can help the firm’s leaders adjust the company vision as needed and build the case for it among employees.

With the initial cost analysis in hand, a manager can consider which levers are available for improvement and evaluate their suitability for itsbusiness modeland culture. Our research finds that six best practices across the industry stand out: centralizing support functions, leveraging lower-cost locations, outsourcing support functions, deploying support staff more effectively, sizing investment teams in line with potential returns, and harnessing AI tools.

Centralizing Support Functions.Few firms need to be sold on the benefits of centralized support functions. Centralization brings global consistency and economies of scale and sets the stage for further efficiencies. Even so, some managers are more siloed than they should be, often because they’ve added new geographies or asset classes in recent years. Companies such as Blackstone, by contrast, have achieved 80% to 90% centralization in fund operations and information technology while keeping functions like portfolio operations and value creation strategically decentralized.

Leveraging Lower-Cost Locations.Most first- and second-tier firms operate in multiple regions, giving them choices about where to base centralized support functions. Costs, especially for personnel, already play a role in these decisions, and they take on additional importance during a down cycle. Lower-cost locations can be within one of the organization’s major markets (as when a New York firm puts its technology hub in Atlanta) or further afield (if it locates back-office facilities in Manila or Gurgaon). Sometimes a lower-cost location is home to a full range of firm activities—as is the case for Partners Group’s US headquarters near Denver—but more often it is chosen to control costs in one or more functions.

The lower-cost location lever is especially useful in fund operations and technology, as demonstrated by three prominent managers (Blackstone, KKR, and Partners Group) for which relevant data is available. (See Exhibit 2.) Not coincidentally, these functions are the ones most characterized by routine processes that can be standardized, making it easier to perform them across time zones, languages, and cultures.

Outsourcing Support Functions.Some managers have gone a step further in leveraging lower-cost locations and labor pools by outsourcing functions to service providers. Because the handoff to an outside partner is even more complicated than the transfer to a new in-house location, there’s also a greater need for standardization, appropriate tools for interaction, and clear delineation of roles.

The payoff can be significant. For one global manager, centralizing information technology and fund administration in outsourced “centers of excellence” has been one of the key drivers of a 200%-plus improvement in support-function efficiency, as measured by the ratio of fee-bearing assets under management (AUM) per full-time, non-investment employee. This happened as the firm scaled from around $150 billion in fee-bearing AUM to about $560 billion between 2012 and 2021.

Deploying Support Staff More Effectively.There is wide variety in how non-investment employees are concentrated across functions at leading firms(See Exhibit 3.) This is driven partly by differing business models and strategies but also by untapped efficiencies. Efficiency seekers should therefore view the data not as a call to bring their firms in line with the medians but rather as a tool for exploring whether their own areas of concentration match their goals.

A big push in cloud migration, for example, could be a sound reason for a temporary concentration in technology, whereas a low concentration in tech could reflect an overreliance on manual processes. Once the cloud migration is complete, the tech headcount is reduced. Managers that invested in a migration to cloud services and process automation in earlier stages of their growth now employ technology teams that are typically about half the size of those at their fourth-quartile peers.

Sizing Investment Teams in Line with Potential Returns.There are also significant differences in the size and seniority of the investment teams at leading alternative asset managers. (See Exhibit 4.) Here too there are firm-specific reasons for the variety, but also cost savings to be had in making sure that the firm is getting the best return on its outlays for investment talent.

Staffing needs differ across strategies, of course. Credit investments require less hands-on management than private equity (PE). Within PE, an investment based on active value creation, such as a roll-up, needs a larger team than a well-managed recapitalization play would require. The opportunity for increased efficiency lies in ensuring that these professionals’ time and attention line up well with the specific needs—and potential returns—of each strategy.

Harnessing AI Tools.It’s too early to quantify the potential efficiency gains from broad deployment of AI, but it’s already clear that they are enormous. In an investment industry known for complexity, potential applications range from fundraising through portfolio companyvalue creationto exit management. Support functions such as fundoperations, accounting, legal, and marketing can reduce or eliminate manual processes. Technology teams can become smaller yet more productive as AI supports low- or no-code solutions to process bottlenecks.

AI is best thought of not as a single lever but as an adaptable productivity engine that can boost performance in settings across the firm. Managers should consider its potential to help them improve support staff productivity and deploy investment teams more effectively. Some other attractive AI applications in alternative asset management include support for investment due diligence and identification of investment themes and targets. (See Exhibit 5.)

Some of the efficiency measures outlined here can fairly be described as playing catchup, while others could be considered trailblazing. When firms compare the full scope of their operations to those of their peers, most will find opportunities to do both kinds of work. What comes next is the harder part: setting the direction, getting buy-in from employees who are changing the ways they work, clearly establishing initiatives and their owners, tracking progress, and all the other facets of successfully executing on change in a complex organization. Even for firms that choose to focus on the lower-hanging fruit, the importance of getting the execution right shouldn’t be underestimated.

但毫无疑问,工作将支付的f. A 5% profit margin improvement is a realistic goal in most cases, and the current slowdown is an ideal time to pursue it. Using peer comparisons, alternative asset managers can improve both the profit margins and resilience of their businesses and lay the foundation for future growth.

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2023. All rights reserved.

For information or permission to reprint, please contact BCG atpermissions@bcg.com.To find the latest BCG content and register to receive e-alerts on this topic or others, please visitbcg.com.Follow Boston Consulting Group onFacebookandX (formerly Twitter).

Related Content

Read more insights from BCG’s teams of experts.

As countries around the world rebuild their infrastructure for sustainability, private investors are gravitating toward low-carbon hydrogen projects.

Brands have a powerful opportunity to increase the bottom line in an uncertain economic environment. Here’s how consumer packaged goods leaders can improve price realization.

BCG’s consulting experts work with leaders in the asset management industry to promote growth, develop innovative strategies, and build competitive advantage.

Scaling artificial intelligence can create a massive competitive advantage. Learn how our AI-driven initiatives have helped clients extract value.

SUBSCRIBE